Understanding Gold IRA Rollovers: A Comprehensive Case Examine

페이지 정보

작성자 Michelle 작성일25-07-28 00:18 조회2회 댓글0건본문

Lately, the idea of investing in gold via Particular person Retirement Accounts (IRAs) has gained vital traction amongst investors in search of to diversify their portfolios and protect their wealth from economic instability. This case examine explores the means of a gold IRA rollover, examining the motivations, procedures, advantages, and potential pitfalls associated with such a financial technique.

Background

The client, whom we'll confer with as John, is a 55-yr-outdated monetary consultant who has been saving for retirement for over 30 years. With a conventional IRA primarily invested in stocks and bonds, John turned increasingly involved about market volatility and inflation eroding his savings. After researching various funding options, he concluded that diversifying a portion of his retirement savings into bodily gold could provide a hedge against economic uncertainty.

Motivation for Rollover

John's main motivations for contemplating a gold IRA rollover included:

- Inflation Safety: With rising inflation charges, John feared that traditional investments could lose value, prompting him to hunt a more stable store of value.

- Market Volatility: The unpredictability of inventory markets led John to explore different investments that traditionally maintain their worth throughout financial downturns.

- Lengthy-time period Wealth Preservation: John considered gold as a protracted-term investment that could preserve his wealth and provide safety for his retirement years.

Understanding Gold IRAs

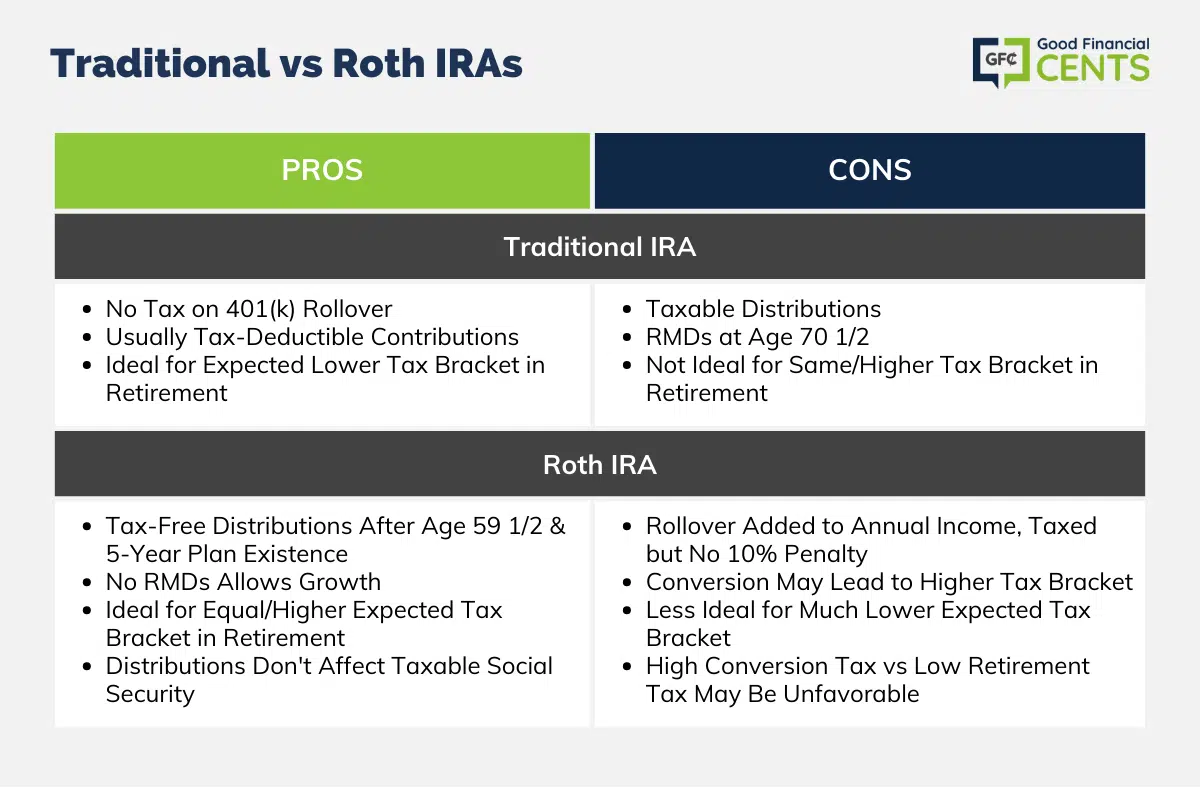

A gold IRA is a self-directed Individual Retirement Account that allows investors to carry physical gold and different valuable metals. Unlike traditional IRAs, which usually include paper property, gold IRAs present a tangible asset that can act as a hedge against inflation and market downturns.

The Rollover Process

John started his journey by researching reputable gold IRA custodians and dealers. After cautious consideration, he selected a custodian with a strong fame and a transparent payment construction. Here’s a step-by-step breakdown of the rollover process John followed:

- Consultation with a Monetary Advisor: John sought advice from a financial advisor specializing in precious metals to understand the implications of a gold IRA rollover and guarantee it aligned along with his retirement objectives.

- Opening a Gold IRA: John accomplished the necessary paperwork to open a self-directed gold IRA together with his chosen custodian. This included offering private data, selecting beneficiaries, and agreeing to the phrases and circumstances.

- Initiating the Rollover: John contacted his traditional IRA supplier to provoke the rollover course of. He requested a direct switch of funds, ensuring that the transaction would not incur tax penalties. If you have any thoughts relating to the place and how to use Affordable options for gold-backed iras (http://Bolsatrabajo.Cusur.Udg.mx), you can speak to us at our web-site. The provider facilitated the switch of funds to the new gold IRA custodian.

- Selecting Treasured Metals: Once the funds were transferred, John labored together with his custodian to pick the forms of gold he wanted to spend money on. He opted for American Gold Eagles and Canadian Gold Maple Leafs, each of which are IRS-authorised bullion coins.

- Buying Gold: After finalizing his selections, the custodian executed the acquisition of the gold on John’s behalf. The physical gold was then saved in an IRS-authorised depository, ensuring its safety and compliance with rules.

Benefits of the Gold IRA Rollover

John skilled several benefits as a result of his gold IRA rollover:

- Diversification: By including gold to his retirement portfolio, John diversified his investments, lowering his total threat publicity.

- Wealth Preservation: The bodily gold supplied John with peace of mind, knowing that he had a tangible asset that could retain worth in instances of financial uncertainty.

- Tax Advantages: The rollover allowed John to switch his retirement funds with out incurring rapid tax liabilities, preserving his capital for future progress.

- Lengthy-term Growth Potential: Traditionally, gold has shown resilience and appreciation over time, making it an attractive choice for long-term buyers like John.

Potential Pitfalls to contemplate

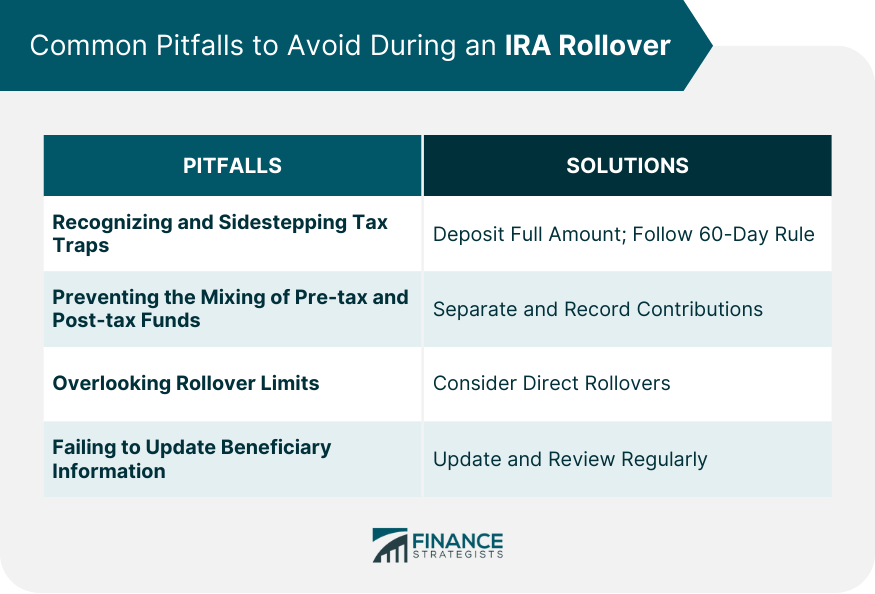

While John’s experience with the gold IRA rollover was largely positive, it is important to consider potential pitfalls that investors may encounter:

- Market Fluctuations: The worth of gold might be unstable, and whereas it serves as a hedge against inflation, it could not always provide the expected returns within the quick time period.

- Storage and Insurance Prices: Investing in bodily gold includes storage and insurance expenses that may eat into potential income. John had to account for these prices when evaluating his total investment strategy.

- Limited Liquidity: Not like stocks and bonds, promoting physical gold can take time and will involve additional fees. Buyers needs to be prepared for potential delays in accessing their funds.

- Regulatory Compliance: Gold IRAs should adjust to IRS rules, affordable options for gold-backed iras and failure to adhere to those guidelines can lead to penalties. It's crucial for traders to work with educated custodians to make sure compliance.

Conclusion

John’s case research illustrates the potential benefits and challenges of a gold IRA rollover. By diversifying his retirement portfolio with physical gold, he aimed to protect his wealth from inflation and market volatility. Whereas the strategy of rolling over to a gold IRA could be easy, it is crucial for investors to conduct thorough analysis, seek skilled recommendation, and perceive the associated dangers. As financial conditions continue to evolve, gold IRAs could stay a compelling choice for these seeking to safeguard their retirement financial savings and safe their monetary future.

댓글목록

등록된 댓글이 없습니다.