Versatile Loan Choices To Swimsuit You

페이지 정보

작성자 Rolando 작성일24-12-07 00:19 조회9회 댓글0건본문

Early termination fee does not apply in the last 6 months of the loan time period. Whether you need a brand new home, car, a better loan, or only a serving to hand locally, we’re here for you. Had good communication all the method in which through.i had good credit scores they usually was a bit slower in response however I’m pleased as I received to purchase my car for my work . If you are a Firstmac buyer you can now add your Firstmac card to Apple Pay for a straightforward way to faucet and pay. Whilst each effort is taken to make sure that charges are updated, Arab Bank Australia takes no responsibility for errors herein.

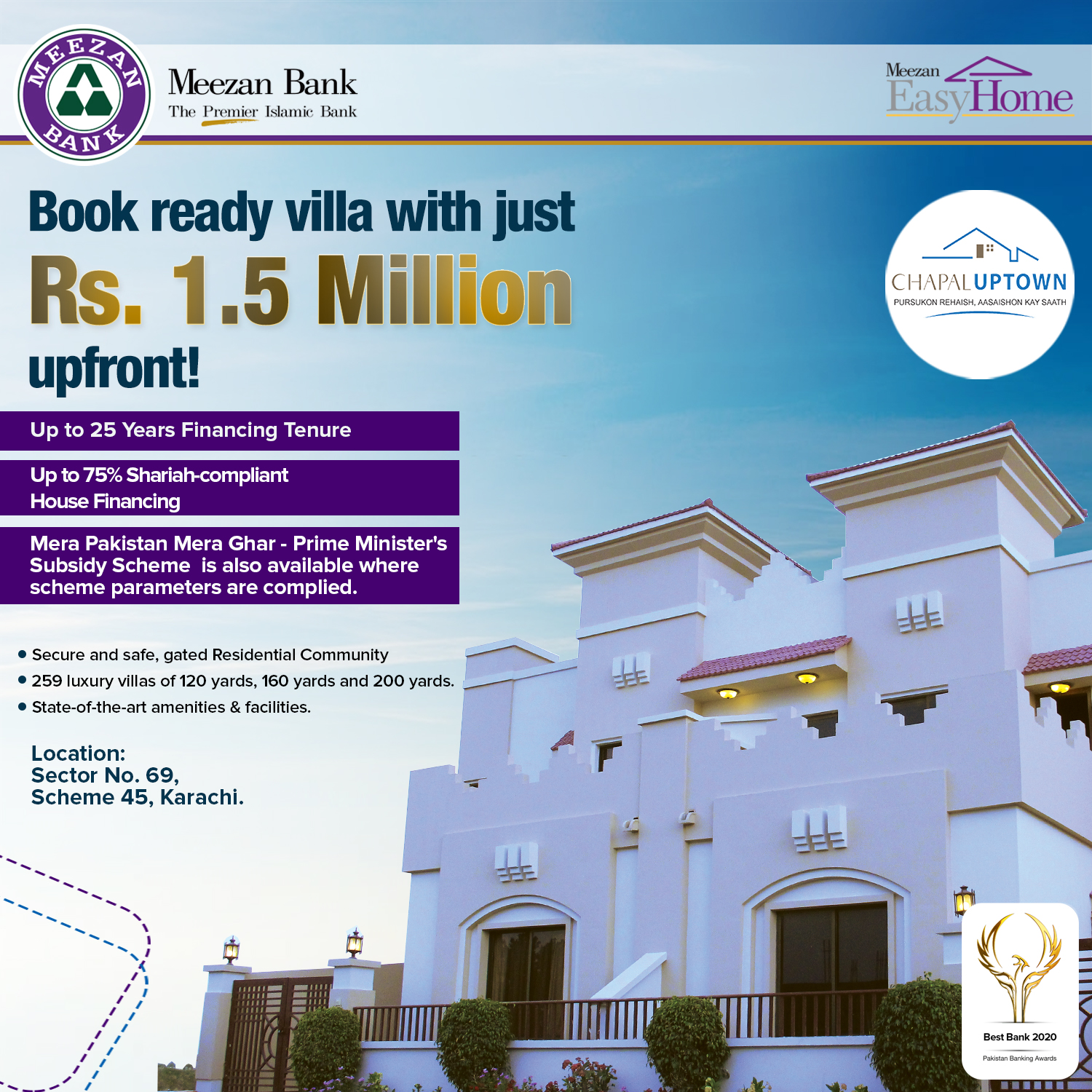

Early termination fee does not apply in the last 6 months of the loan time period. Whether you need a brand new home, car, a better loan, or only a serving to hand locally, we’re here for you. Had good communication all the method in which through.i had good credit scores they usually was a bit slower in response however I’m pleased as I received to purchase my car for my work . If you are a Firstmac buyer you can now add your Firstmac card to Apple Pay for a straightforward way to faucet and pay. Whilst each effort is taken to make sure that charges are updated, Arab Bank Australia takes no responsibility for errors herein.In Islamic banking, the idea of revenue sharing and threat sharing is emphasised, and all transactions must be free from parts of usury (riba) and unce... These loans perform based on the principles of Shariah regulation, which prohibits the charging or receiving of curiosity. Security measures are the crucial backbone of Halal financing, guaranteeing the protection and integrity of investments for all parties involved. Halal loans are ruled by a set of rules and pointers derived from Islamic law, generally known as Shariah. These measures are put in place to mitigate dangers and keep the legitimacy of the monetary transactions ... The unique construction of Halal Mortgage, ruled by Islamic legislation, ensures that individuals have entry to home finance choices that align with their religion. Collateral plays an important position in the context of halal loans, contributing significantly to the general importance of the loan construction.

The concept of Halal Mortgage in Islam is not solely about monetary transactions but in addition about fostering neighborhood solidarity and ethical banking sustainability. Halal loans have gained recognition among people in search of Islamic-compliant monetary options. This has been driven by a younger and fast-growing global inhabitants that extends past the core 1.9 billion Muslim customers to include a wider world ethical shopper market, the analysis discovered.

In Australia, where residence financing practices differ, guaranteeing transparency in the loan-to-value ratios and the refinancing of home loans for owner-occupiers and buyers is pivotal. "It has become more and more popular among Muslims who want to invest their money in a means that aligns with their religious beliefs," Shaik mentioned. The Mudarabah system, which includes a partnership between a trustee (or Rab-ul-mal) and an entrepreneur (or Mudarib), is a major factor of Halal Mortgage agreements.

A transient, helpful information to the rules of Islamic Finance, delivered by an Australia-based authority in the field, Almir Colan. Understanding the revenue standards for Halal loans is essential for anyone looking to safe Shariah-compliant financing.

Understanding the authorized framework for Halal loans is important for people and companies who want to engage in Islamic finance. These brokers typically provide clear tips and help all through the applying process. For the Muslim neighborhood in Australia, the supply of Islamic car finance suppliers such as Halal Loans offers financial alternate options to conventional car loans that adhere to Islamic rules. Next, submit the required documents, including proof of earnings, identification, and particulars of the desired automobile. By adhering to the principles outlined by Shariah boards and finance associations, the process may be streamlined for the profit of all events involved. Initially, identify a good broker or financial institution that offers sharia-compliant Islamic monetary products. Striking the right stability between them is essential to ensure you benefit from your borrowing expertise.

Because financing a automobile for a Muslim using Riba (interests) and funds beforehand used for non-halal activities are prohibited. The most essential criterion of Islamic car financing is the absence of interest. Before I clarify let’s have a look at how conventional car financing works when utilizing an accredited Islamic lender. Instead, Islamic finance choices similar to asset finance and cost-plus financing are employed. Car financing in Islamic Bank is regularly based on the murabaha principle. The profit margin is agreed upon upfront, guaranteeing ethical and interest-free transactions.

Afterwards, the listing of greatest banks for car loans in Pakistan is seen on the display. The month-to-month installment, initial deposit (down payment), and processing payment are displayed with the record of the banks. Once you select a car that you just wish to personal, ICFAL purchases the car from the dealership and sells it to you in installment with a pre-agreed markup. If you treasured this article and you also would like to receive more info relating to Muslim-friendly vehicle finance options i implore you to visit the web site. In Islamic finance, the lender and borrower enter into a partnership for the acquisition and leasing of the asset. These embody Faysal Bank Limited, MCB Islamic Bank, Dubai Islamic Bank, MCB Bank Limited, Al Barakah Bank Limited, and Bank of Punjab. So, you have to do comprehensive research with the help of our bank car installment calculator before applying. ICFAL proposed to make the Ijaarah house finance mannequin more like rental legal guidelines than credit score legal guidelines. Reputation, terms and conditions, and customer service are some factors to consider. Additionally, checking testimonials and in search of recommendations can show useful. This careful method will make sure you discover the best Murabahah car finance deal that fits your wants and aligns together with your values. Musharaka is a partnership between the bank and the shopper, which is after they jointly purchase the car.

Islamic loans adhere to Islamic rules, which prohibit the fee or acceptance of curiosity. We provide car financing within the case of both new and used cars with low car markup.

ICFAL offered some changes to how Ijaarah finance contracts work in Australia. You can get car financing on your desired vehicle with the help of the most effective car financing banks in Pakistan. Invest your hard-earned cash the halal method to personal the home and call it house.

Selecting the best provider for your Sharia-compliant car finance is crucial.

댓글목록

등록된 댓글이 없습니다.