10.Three Recording Depreciation Expense For A Partial 12 months

페이지 정보

작성자 Frankie 작성일24-12-28 02:42 조회6회 댓글0건본문

372,000) in order that a achieve of that amount is recognized. Although positive aspects and losses seem on the earnings assertion, they are often proven separately from revenues and bills. In that method, a decision maker can decide both the income derived from primary operations (revenues much less expenses) and the quantity that resulted from tangential actions such because the sale of a constructing or other property (positive factors less losses). Question: Within the reporting above, the building was bought on January 1 and bought on December 31 so that depreciation was at all times determined and recorded for a full yr. 9. present Glorious Customer service: Throughout the leasing process, prioritize excellent customer service. Promptly handle inquiries, provide clear communication, and guarantee a easy transition from preliminary contact to lease agreement signing. 10. maintain relationships: Once a lease agreement is in place, maintain optimistic relationships together with your lessees. Regularly check-in, tackle any considerations promptly, and provide ongoing assist to foster long-time period partnerships.

Asset leasing is a good new-age alternative investment (AI) possibility and is most well-liked by many companies resulting from its advantages. Before we dig deep into the idea of lease investing, let’s understand its basic idea. Leasing is a financial association wherein an individual or enterprise rents out their property to generate earnings. These belongings can vary from actual property properties, tools, machinery, and autos.

Understanding numerous methods of calculating depreciation expenses is essential for correct monetary reporting and strategic resolution-making. Each method has distinctive traits and could also be more suitable for sure kinds of property or enterprise situations. The straight-line method is the simplest and most widely used approach for calculating depreciation expense. It evenly distributes the depreciable quantity of an asset over its helpful life. If you can't use sure tax deductions in a specific year, they may be carried forward for use in a future yr. Some examples of tax deductions that you just may be ready to carry forward are the house office deduction, internet operating losses (with some limitations), enterprise credits and even capital losses. In case you have staff, you are probably reimbursing them for some bills. This will include issues like entertainment or even travel. Using an accountable plan permits you to reimburse staff for enterprise bills without reporting them as employee income.

The choice of a depreciation methodology will not be arbitrary; it is influenced by several strategic and operational concerns. The character of the asset itself usually dictates probably the most acceptable depreciation method. For instance, technology that becomes obsolete quickly as a consequence of fast advancements may be higher suited to an accelerated depreciation technique, which matches the expense with the asset’s diminishing utility. This involves strategically locating certain capabilities, belongings, and risks in jurisdictions with favorable tax regimes. This will help allocate profits appropriately and guarantee compliance with switch pricing laws. 6. Tax Incentives and Particular Economic Zones: Explore tax incentives and benefits obtainable in sure jurisdictions for specific industries or activities. Some international locations offer special financial zones or free trade zones that present tax advantages, such as diminished company tax charges, customs responsibility exemptions, and streamlined regulatory processes. Maintaining correct and arranged data is significant for efficient business tax planning and compliance.

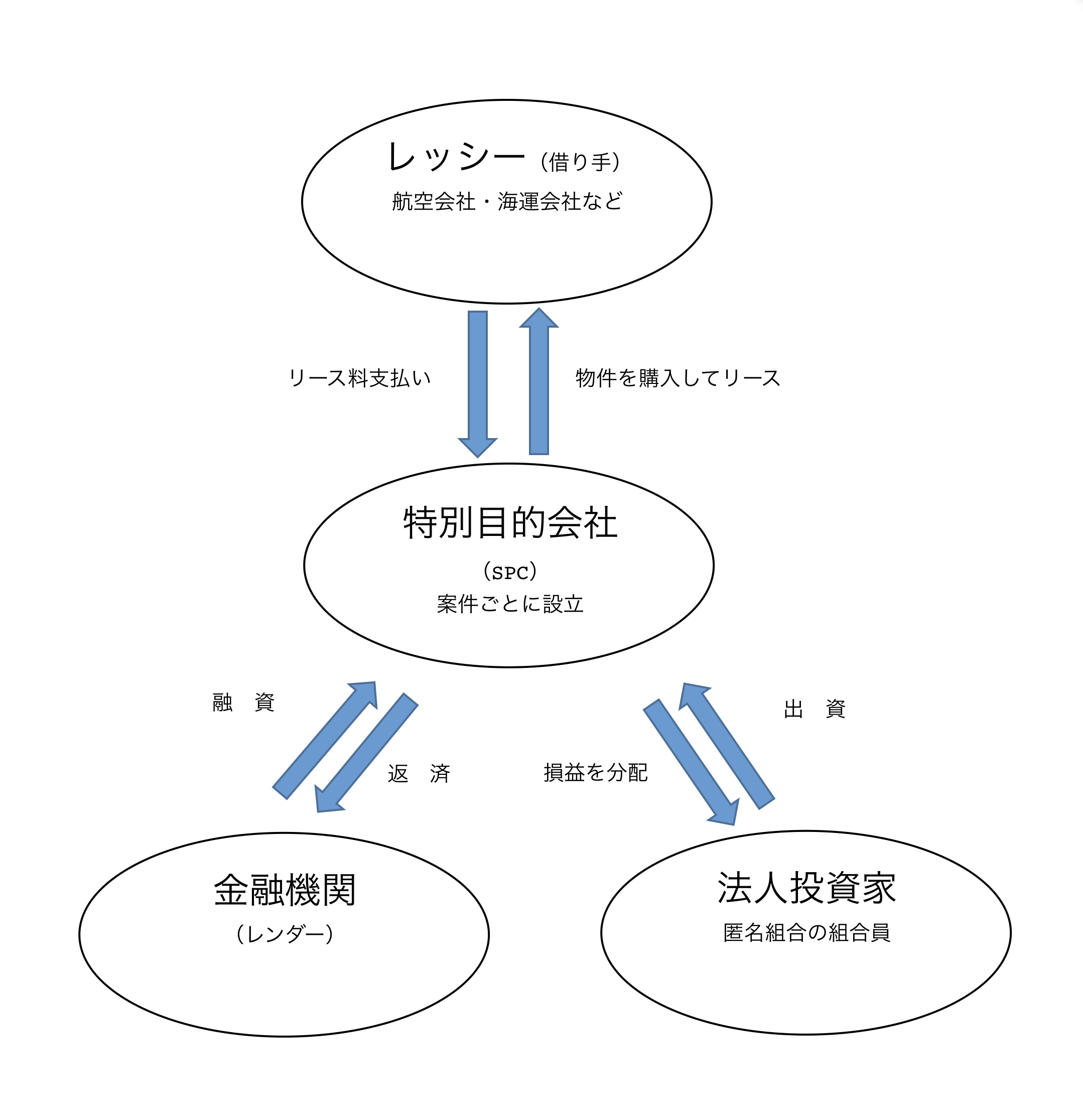

They'll assist in guaranteeing compliance and minimizing tax liabilities. Strategically timing income and expenses is a crucial tax planning tactic for companies. By meticulously controlling when to recognize revenue and incur expenses, businesses can maximize their taxable income and probably lower their total tax burden. 1. Business income deferral: Defer taxable income to reduce your tax burden. Working Leases can be extended at the tip of the lease term; this normally isn’t the case for Finance Leases. How is depreciation dealt with in an Operating Lease vs a Finance Lease? In an Operating Lease, the lessor is liable for the residual worth threat of the vehicle. In a Finance Lease, the lessee takes on this danger and should make a residual lease cost at the end of the lease time period. What happens at the tip of the lease interval in each lease varieties? At the tip of an Working Lease, the lessee returns the automobile to the lessor, オペレーティングリース 節税スキーム or could also be ready to increase the lease time period. At the top of a Finance Lease, ownership of the vehicle is transferred to the lessee, who will likely be required to make a residual payment.

댓글목록

등록된 댓글이 없습니다.