Grasping Gold Trading: Comprehending Rate Motions and also Approaches

페이지 정보

작성자 Irvin 작성일24-03-05 21:09 조회10회 댓글0건본문

In the vibrant world of economic markets, gold trading sticks out as a seasonal preferred amongst capitalists looking for security, diversification, and possible earnings. At the heart of gold trading exists the vital aspect of cost, which is affected by a myriad of financial, geopolitical, as well as market-specific variables. In this detailed direct, we explore the detailed world of gold trading rates, checking out the elements that own them, discovering prominent methods, as well as providing understandings in order to help investors browse this fascinating market.

Comprehending Gold Trading Rates:

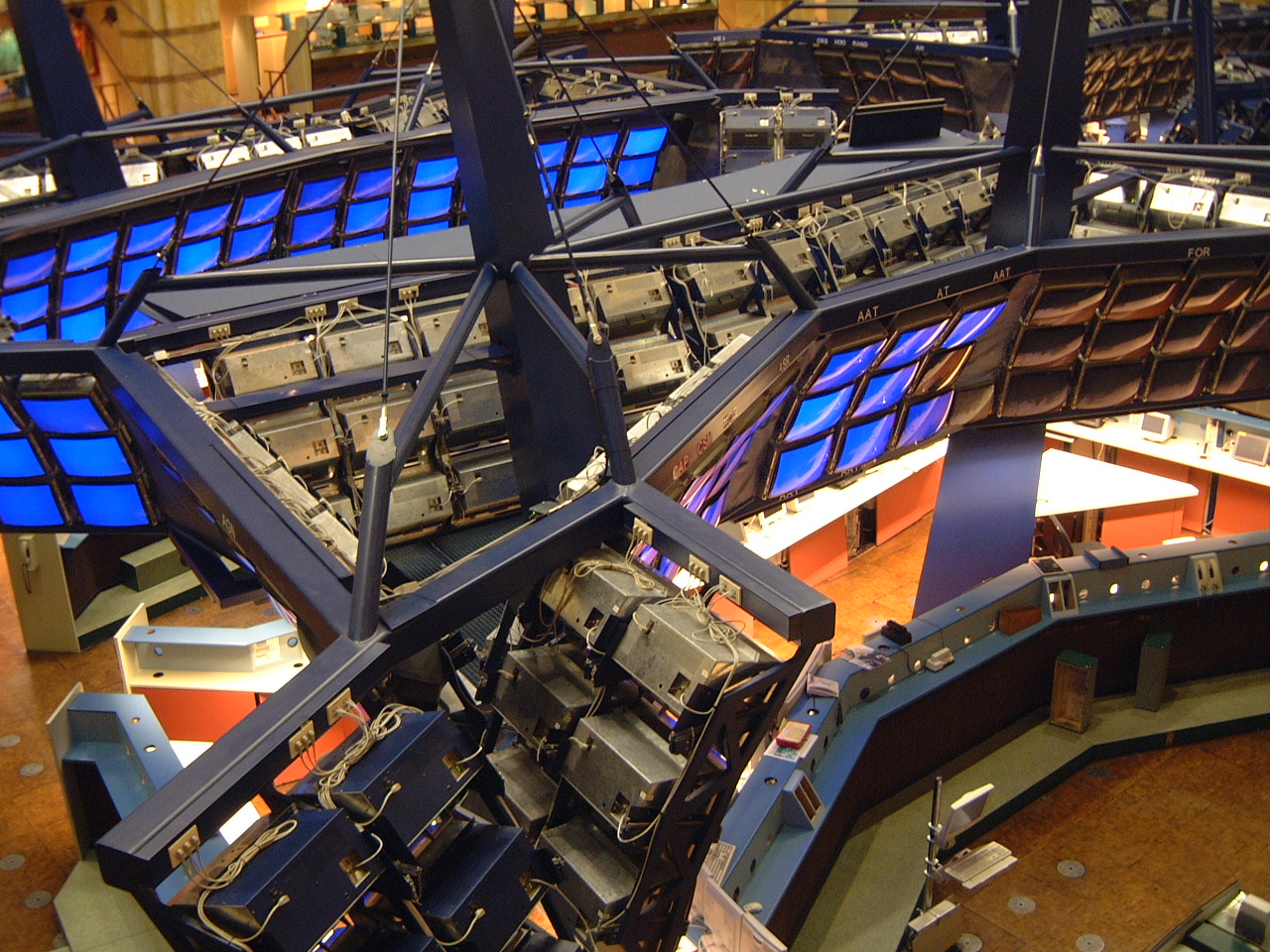

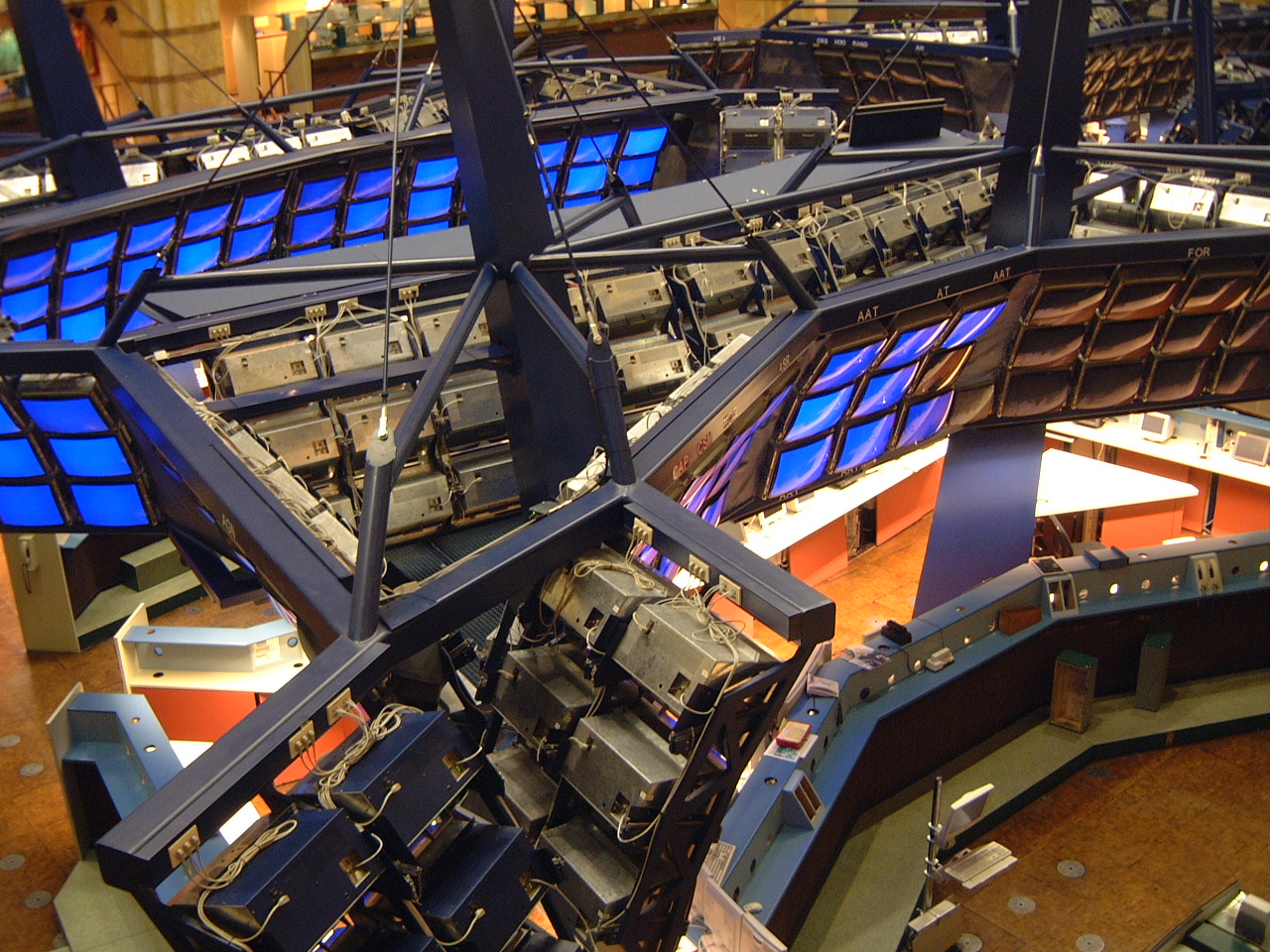

Gold, typically described as the "safe-haven property," is desirable for centuries because of its intrinsic worth, scarcity, and historic importance. As a product, gold is traded around the world, with rates estimated in different moneys such as the US buck (USD), Euro (EUR), and also others. The cost of gold is established via continual trading on exchanges such as the Brand-new York Mercantile Trade (NYMEX) as well as the London Bullion Market Organization (LBMA).

Aspects Affecting Gold Costs:

Financial Signs: Financial information such as GDP development, inflation prices, rates of interest, and also work numbers play a substantial duty fit gold costs. In times of financial unpredictability or recession, financiers typically group to gold as a bush versus inflation and money devaluation, therefore increasing its cost.

Geopolitical Occasions: Geopolitical stress, problems, and situations have an extensive influence on gold rates. Circumstances of political instability, battle, or diplomatic standoffs could rise investor stress and anxiousness, top to raised need for gold as a safe-haven property.

Main Financial institution Plans: Main banks' financial plans, specifically those connect to rate of interest and quantitative alleviating steps, affect gold rates. Decrease rate of interest as well as expansionary financial plans have the tendency to compromise the worth of fiat moneys, production gold much a lot extra eye-catching to financiers looking for riches conservation.

Money Toughness: The toughness or weak point of significant moneys about each various other influences the cost of gold. A weak money usually outcomes in greater gold rates, as it takes much a lot extra systems of the money to buy an ounce of gold.

Provide and Need Characteristics: The provide of and need for physical gold, consisting of fashion precious jewelry, commercial applications, and financial investment need using exchange-traded funds (ETFs) as well as main financial institution books, apply considerable affect on costs. Aspects such as mine manufacturing, reusing prices, and modifications in customer habits could influence provide and also need characteristics.

Gold Trading Methods:

Pattern Adhering to: This technique includes recognizing as well as taking advantage of on developed fads in gold costs. Investors could utilize technological evaluation devices such as removaling averages, trendlines, and energy indications to recognize upwards or down fads and also get in settings as necessary.

Outbreak Trading: Outbreak investors look for to revenue from considerable rate motions adhering to a duration of consolidation or range-bound trading. They get in placements when the rate damages over or listed below vital degrees of assistance or resistance, expecting proceeded energy in the instructions of the outbreak.

Vary Trading: Range-bound markets provide chances for vary trading methods, where investors get close to assistance degrees and also offer close to resistance degrees. This method objectives to maximize rate variations within a specified trading vary, utilizing oscillators such as the Family member Toughness Index (RSI) to determine overbought or oversold problems.

Basic Evaluation: Basic evaluation includes assessing macroeconomic variables, geopolitical occasions, as well as supply-demand characteristics to projection future gold costs. Investors examine financial indications, main financial institution plans, geopolitical advancements, and fads in physical gold need making educated trading choices.

Bring Profession: Lug profession approaches entail obtaining in moneys with low-interest prices and purchasing properties denominated in moneys with greater rates of interest. While not straight appropriate to physical gold trading, gold futures or choices agreements could be utilized in bring profession techniques to take advantage of rate of passion price differentials as well as possible money variations.

Verdict:

Gold trading costs are affected by a plethora of elements, consisting of financial indications, geopolitical occasions, main financial institution plans, money characteristics, and also supply-demand principles. Effective gold trading needs a deep recognizing of these variables, combined with audio threat administration methods and a disciplined method to trading techniques. By remaining notified, using reliable Aplikasi Trading Emas Online techniques, and also adjusting to transforming market problems, investors could browse the intricacies of gold trading as well as confiscate possibilities commercial in this classic market.

Gold trading costs are affected by a plethora of elements, consisting of financial indications, geopolitical occasions, main financial institution plans, money characteristics, and also supply-demand principles. Effective gold trading needs a deep recognizing of these variables, combined with audio threat administration methods and a disciplined method to trading techniques. By remaining notified, using reliable Aplikasi Trading Emas Online techniques, and also adjusting to transforming market problems, investors could browse the intricacies of gold trading as well as confiscate possibilities commercial in this classic market.

Comprehending Gold Trading Rates:

Gold, typically described as the "safe-haven property," is desirable for centuries because of its intrinsic worth, scarcity, and historic importance. As a product, gold is traded around the world, with rates estimated in different moneys such as the US buck (USD), Euro (EUR), and also others. The cost of gold is established via continual trading on exchanges such as the Brand-new York Mercantile Trade (NYMEX) as well as the London Bullion Market Organization (LBMA).

Aspects Affecting Gold Costs:

Financial Signs: Financial information such as GDP development, inflation prices, rates of interest, and also work numbers play a substantial duty fit gold costs. In times of financial unpredictability or recession, financiers typically group to gold as a bush versus inflation and money devaluation, therefore increasing its cost.

Geopolitical Occasions: Geopolitical stress, problems, and situations have an extensive influence on gold rates. Circumstances of political instability, battle, or diplomatic standoffs could rise investor stress and anxiousness, top to raised need for gold as a safe-haven property.

Main Financial institution Plans: Main banks' financial plans, specifically those connect to rate of interest and quantitative alleviating steps, affect gold rates. Decrease rate of interest as well as expansionary financial plans have the tendency to compromise the worth of fiat moneys, production gold much a lot extra eye-catching to financiers looking for riches conservation.

Money Toughness: The toughness or weak point of significant moneys about each various other influences the cost of gold. A weak money usually outcomes in greater gold rates, as it takes much a lot extra systems of the money to buy an ounce of gold.

Provide and Need Characteristics: The provide of and need for physical gold, consisting of fashion precious jewelry, commercial applications, and financial investment need using exchange-traded funds (ETFs) as well as main financial institution books, apply considerable affect on costs. Aspects such as mine manufacturing, reusing prices, and modifications in customer habits could influence provide and also need characteristics.

Gold Trading Methods:

Pattern Adhering to: This technique includes recognizing as well as taking advantage of on developed fads in gold costs. Investors could utilize technological evaluation devices such as removaling averages, trendlines, and energy indications to recognize upwards or down fads and also get in settings as necessary.

Outbreak Trading: Outbreak investors look for to revenue from considerable rate motions adhering to a duration of consolidation or range-bound trading. They get in placements when the rate damages over or listed below vital degrees of assistance or resistance, expecting proceeded energy in the instructions of the outbreak.

Vary Trading: Range-bound markets provide chances for vary trading methods, where investors get close to assistance degrees and also offer close to resistance degrees. This method objectives to maximize rate variations within a specified trading vary, utilizing oscillators such as the Family member Toughness Index (RSI) to determine overbought or oversold problems.

Basic Evaluation: Basic evaluation includes assessing macroeconomic variables, geopolitical occasions, as well as supply-demand characteristics to projection future gold costs. Investors examine financial indications, main financial institution plans, geopolitical advancements, and fads in physical gold need making educated trading choices.

Bring Profession: Lug profession approaches entail obtaining in moneys with low-interest prices and purchasing properties denominated in moneys with greater rates of interest. While not straight appropriate to physical gold trading, gold futures or choices agreements could be utilized in bring profession techniques to take advantage of rate of passion price differentials as well as possible money variations.

Verdict:

Gold trading costs are affected by a plethora of elements, consisting of financial indications, geopolitical occasions, main financial institution plans, money characteristics, and also supply-demand principles. Effective gold trading needs a deep recognizing of these variables, combined with audio threat administration methods and a disciplined method to trading techniques. By remaining notified, using reliable Aplikasi Trading Emas Online techniques, and also adjusting to transforming market problems, investors could browse the intricacies of gold trading as well as confiscate possibilities commercial in this classic market.

Gold trading costs are affected by a plethora of elements, consisting of financial indications, geopolitical occasions, main financial institution plans, money characteristics, and also supply-demand principles. Effective gold trading needs a deep recognizing of these variables, combined with audio threat administration methods and a disciplined method to trading techniques. By remaining notified, using reliable Aplikasi Trading Emas Online techniques, and also adjusting to transforming market problems, investors could browse the intricacies of gold trading as well as confiscate possibilities commercial in this classic market.댓글목록

등록된 댓글이 없습니다.