The Role of IRA Gold Custodians In Trendy Retirement Planning

페이지 정보

작성자 Stacy 작성일25-07-23 19:20 조회2회 댓글0건본문

In recent times, the concept of self-directed Particular person Retirement Accounts (IRAs) has gained vital traction among buyers seeking to diversify their retirement portfolios. Amongst the various asset courses obtainable for these accounts, gold and other treasured metals have emerged as widespread choices. This pattern has led to the rise of IRA gold custodians, specialised financial establishments that facilitate the holding of gold in retirement accounts. This text explores the function of IRA gold custodians, their capabilities, and the implications for traders.

Understanding IRA Gold Custodians

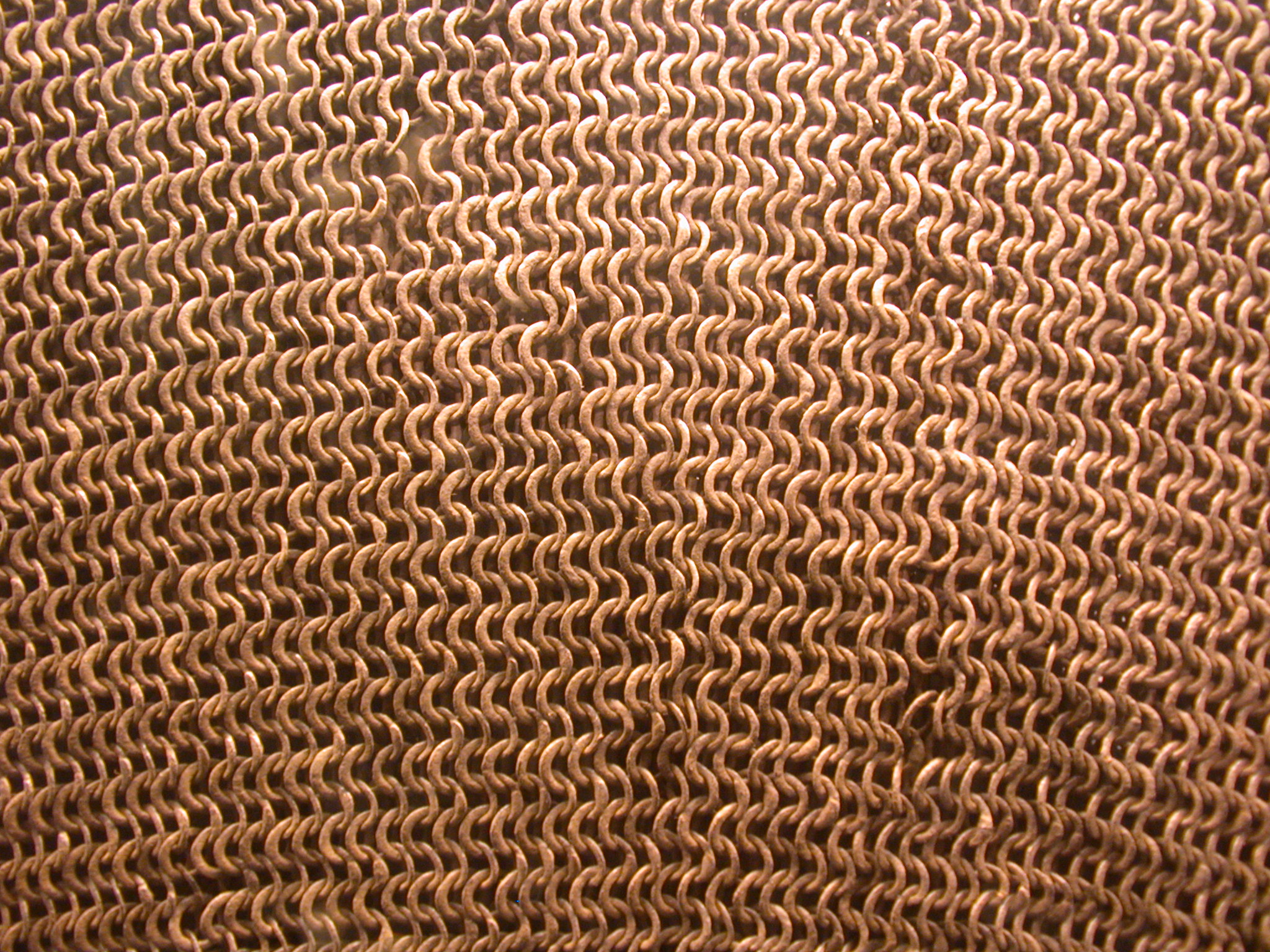

An IRA gold custodian is a monetary establishment that holds and safeguards physical gold and different treasured metals on behalf of IRA account holders. Not like conventional IRAs that sometimes spend money on stocks, bonds, and mutual funds, self-directed IRAs permit buyers to allocate funds towards various belongings, together with gold bullion, coins, and even actual estate. The custodian plays a important function in making certain that these investments adjust to IRS rules whereas providing a secure storage solution for the physical belongings.

The Importance of Custodians in IRA Management

- Regulatory Compliance: One among the first responsibilities of an IRA gold custodian is to ensure compliance with IRS regulations governing self-directed IRAs. The IRS has strict tips concerning the kinds of valuable metals that can be held in an IRA, including purity standards and acceptable forms of gold. Custodians should ensure that every one assets meet these criteria to keep away from penalties and tax implications for account holders.

- Safe Storage: Physical gold requires safe storage to forestall theft or loss. IRA gold custodians sometimes partner with respected storage facilities, corresponding to banks or vaults, to provide a safe surroundings for the property. This side of custodianship is crucial, as traders can't personally store their gold at residence or in a safe deposit field with out risking the tax-advantaged standing of their IRA.

- Transaction Facilitation: Custodians facilitate the shopping for, promoting, and transferring of gold inside an IRA. They handle the paperwork and guarantee that each one transactions comply with IRS regulations. This not solely simplifies the process for investors but additionally provides a layer of safety against potential fraud or mismanagement.

- File Preserving: IRA gold custodians maintain detailed records of all transactions, holdings, and valuations of the treasured metals inside the account. This documentation is essential for tax reporting and compliance functions, providing buyers with peace of mind that their belongings are being managed responsibly.

Choosing the proper IRA Gold Custodian

Deciding on a good IRA gold custodian is a crucial step for buyers looking to include gold of their retirement portfolios. Here are some components to contemplate when selecting a custodian:

- Fame and Experience: Traders ought to analysis potential custodians to evaluate their fame in the trade. Search for custodians with a confirmed observe document and optimistic customer opinions. Expertise in managing valuable metals IRAs is also a priceless asset.

- Fees and Fees: Custodians usually charge charges for their companies, including account setup, annual upkeep, and transaction fees. It is essential for traders to know the price structure and compare prices amongst totally different custodians to ensure they are getting a good deal.

- Storage Choices: Investors should inquire in regards to the storage choices out there by means of the custodian. If you loved this post and you would certainly such as to get more details regarding trusted companies for ira in precious metals [just click the next article] kindly visit our own internet site. Some custodians supply segregated storage, the place an investor’s gold is saved separately from others, while others may use commingled storage. Understanding these choices can impact the level of security and peace of mind for the investor.

- Customer service: A custodian's customer service can considerably have an effect on the general expertise for traders. Look for custodians that provide responsive support and are willing to answer questions on the method and their providers.

The benefits of Investing in Gold By way of an IRA

Investing in gold through an IRA presents several advantages that appeal to buyers:

- Diversification: Gold is often seen as a safe-haven asset that can assist diversify an investment portfolio. Throughout times of financial uncertainty or market volatility, gold tends to retain its worth, making it an attractive possibility for risk-averse traders.

- Tax Advantages: Holding gold in an IRA allows traders to benefit from tax-deferred progress. Which means that any gains made from the appreciation of gold aren't taxed until the investor withdraws the funds, probably leading to important tax savings over time.

- Hedge Towards Inflation: Gold has historically been considered a hedge against inflation. As the buying power of fiat currencies declines, gold usually maintains its worth, making it an appealing asset for long-term buyers involved about inflationary pressures.

Challenges and Concerns

While there are numerous advantages to investing in gold by means of an IRA, there are also challenges and Trusted companies for ira in precious metals issues that buyers should be aware of:

- Market Volatility: The worth of gold can be unstable, influenced by various financial elements, together with curiosity charges, forex values, and geopolitical occasions. Buyers ought to be prepared for fluctuations in the worth of their gold holdings.

- Regulatory Modifications: The regulatory landscape surrounding IRAs and treasured metals can change, doubtlessly impacting the rules governing custodianship and the types of belongings that may be held in an IRA. Staying knowledgeable about these changes is important for buyers.

- Lengthy-Time period Commitment: Investing in gold via an IRA is often a long-time period commitment. Buyers should have a clear understanding of their investment goals and time horizon before allocating funds to this asset class.

Conclusion

IRA gold custodians play a significant function in the modern retirement planning panorama, offering traders with the opportunity to diversify their portfolios with precious metals. By ensuring regulatory compliance, facilitating transactions, and providing secure storage options, custodians help buyers navigate the complexities of self-directed IRAs. As the curiosity in gold as an funding continues to grow, understanding the role of custodians and the advantages and challenges related to gold IRAs can be crucial for traders looking for to enhance their retirement strategies.

댓글목록

등록된 댓글이 없습니다.